An eye-watering £4.5billion loss is expected to be suffered across Europe’s top six leagues as a result of the coronavirus pandemic, according to a new report from KMPG.

The international audit company have compiled an in-depth study into the effects the ongoing Covid-19 chaos caused last season, with particular focus given to the 2020/21 champions of the major European divisions.

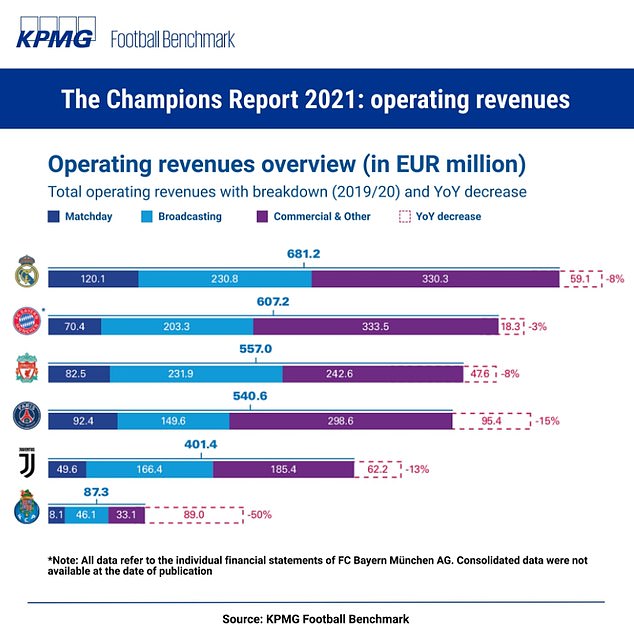

All six champions, Real Madrid, Juventus, Liverpool, Porto, PSG and Bayern Munich, saw a decrease in operating revenues with estimated losses in that department across those six divisions reaching -€5B.

Interestingly, only Bayern and Real managed to finish last season with any net profit for the financial year, despite the fact that the Spanish side lost out the most in matchday income (-€34.9m, a 22% year-on-year drop).

PSG were the worst affected, losing €95.4m, followed by Porto (-€89m) and then Juventus (-€62.2m). Liverpool were not included in this section of the report as the club are yet to release detailed financial information on staff costs and profitability figures.

Clubs who made it deep into the Champions League, such as finalists PSG and Bayern, were boosted in terms of broadcasting revenue, only dropping 4 per cent from last season.

Whereas Real Madrid, Juventus and Liverpool) suffered an annual decrease of 12, 19 and 22 per cent respectively as they were all knocked out at the last-16 stage.

Dramatic drops in matchday revenue with no fans in attendance hit all teams hard, especially those further down the pyramid.

One section of the report reflected that the pandemic has helped expose flaws that already existed in the way some clubs were being run.

It read: ‘It is crucial to note that, even prior to the pandemic, there was a general consensus that inflated players’ salaries, coupled with growing transfer and agent fees, were placing significant strain on clubs’ finances.

‘The crisis has magnified these flaws in the current business model, where working from home is also not possible. In an industry already characterised by limited liquidity, minor disruptions paling in comparison to COVID-19, such as the volatility of qualification to certain competitions or player trading income, had already driven some clubs into real financial distress.

‘The present global health emergency has further exposed the vulnerability of the football ecosystem and thrown its financial sustainability into question, even in the short term.’

There has inevitably also been an impact on the prices of players. The KPMG Player Valuation Tool showed that the aggregate market value of the 500 most valuable stats decreased by 9.6 per cent between February 2020 and January 2021.

The report predicts that the next five years of the football industry ‘will look very different’.

And with the Covid-19 situation worsening in recent weeks, that forecast looks all the more accurate.